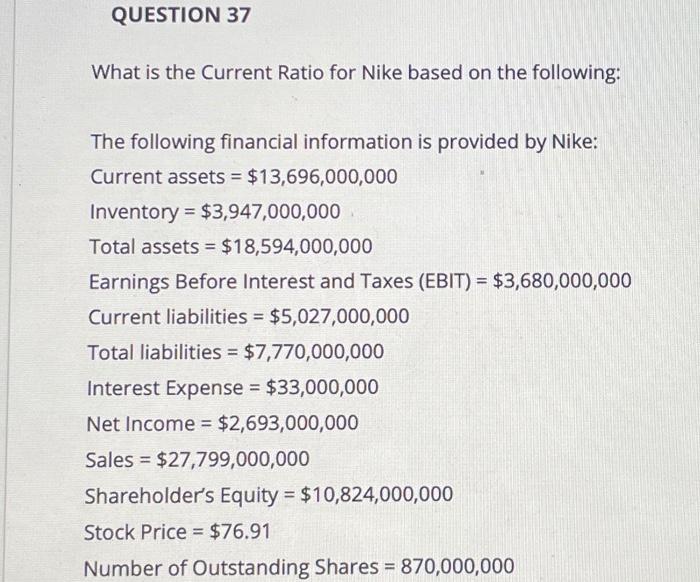

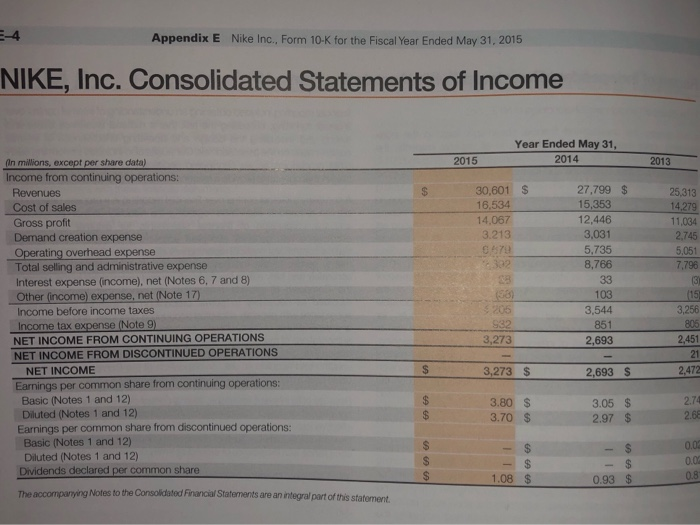

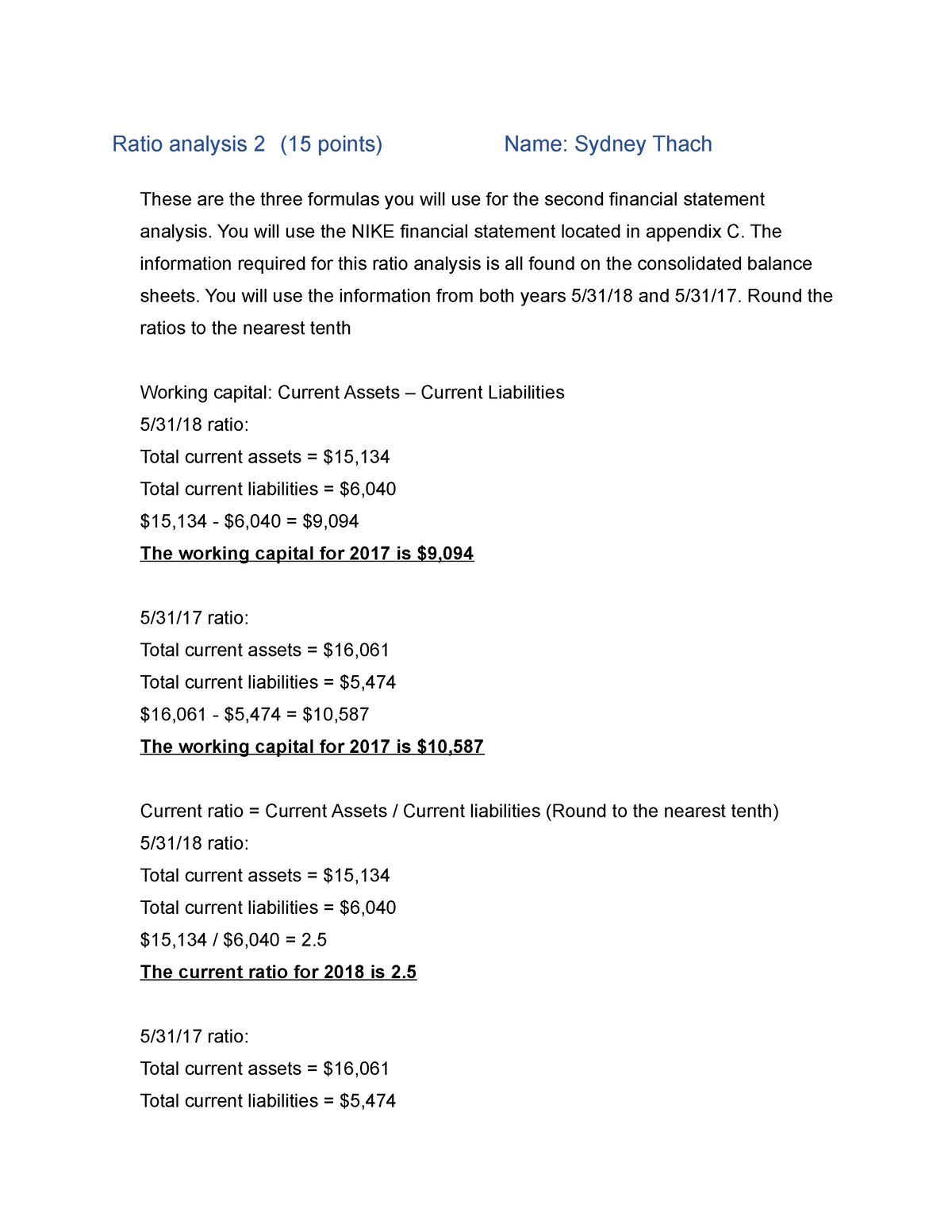

FS 2 working capital, current ratio, quick ratio - Ratio analysis 2 (15 points) Name: Sydney Thach - Studocu

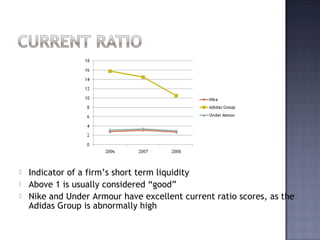

Current Assets Compared with Current Liabilities in Financial Reporting and Analysis Tutorial 22 May 2023 - Learn Current Assets Compared with Current Liabilities in Financial Reporting and Analysis Tutorial (12505) | Wisdom Jobs India

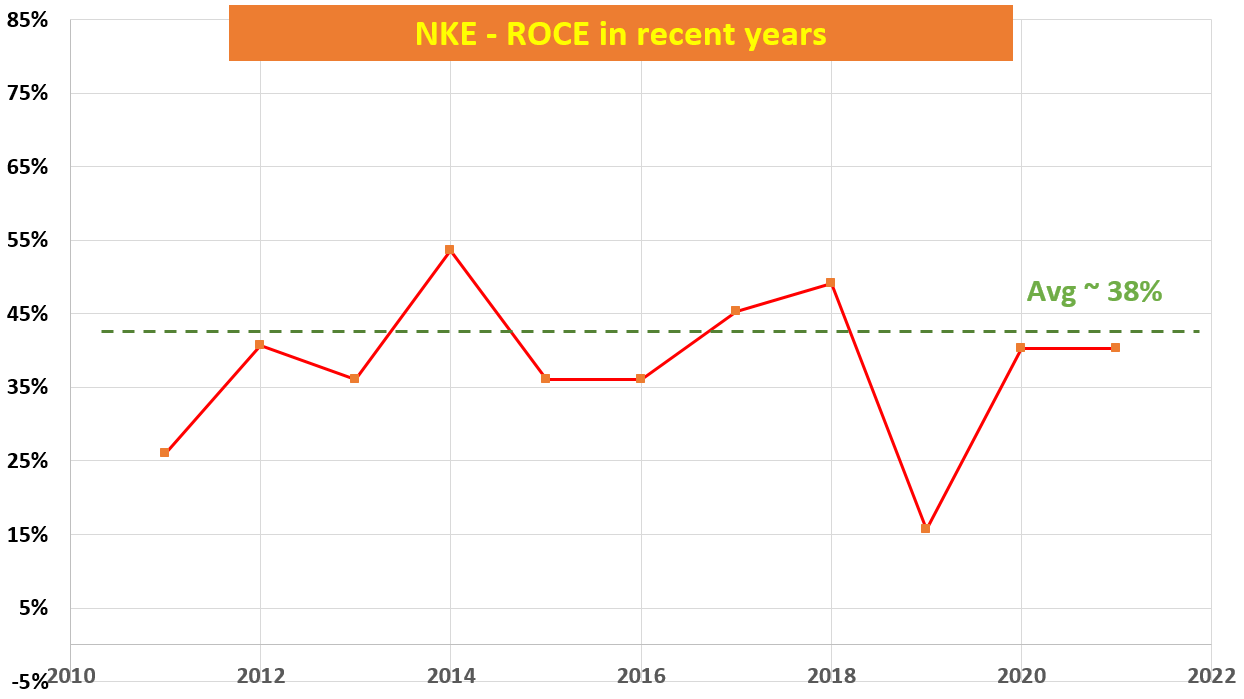

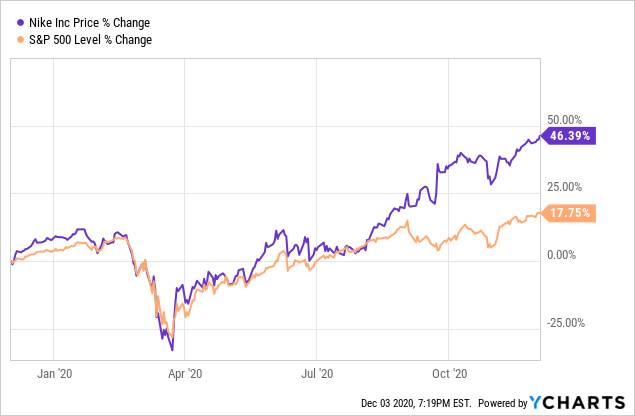

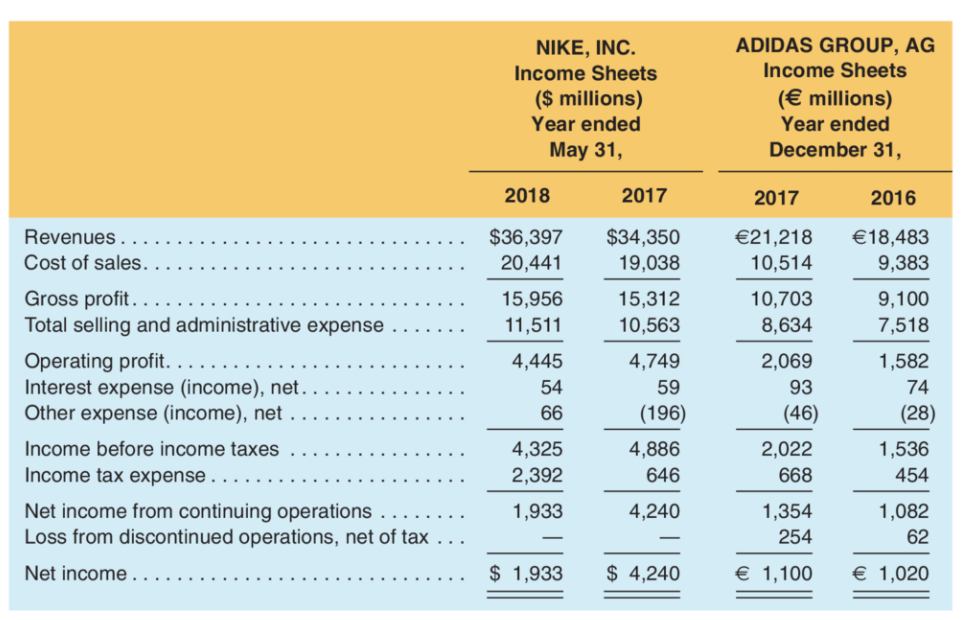

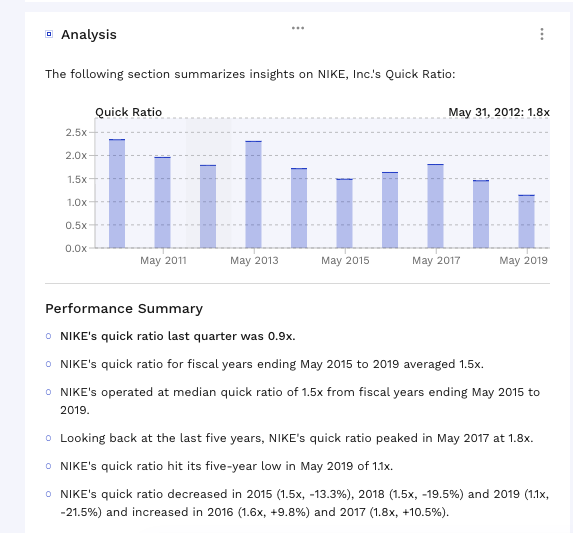

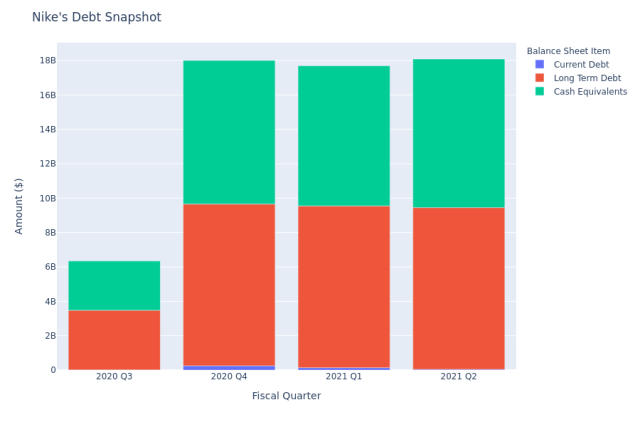

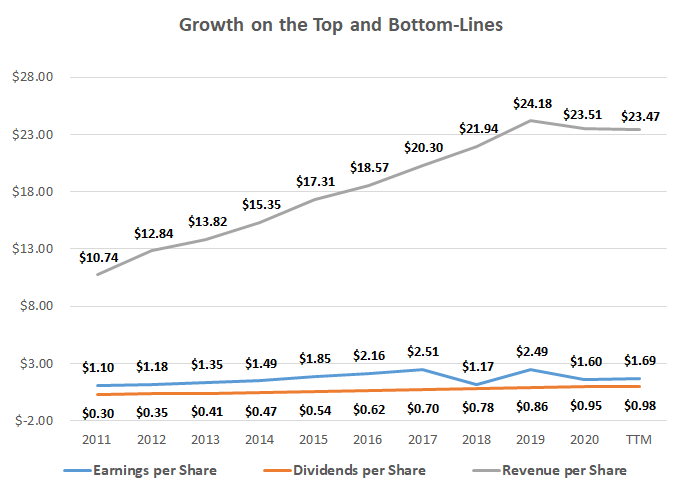

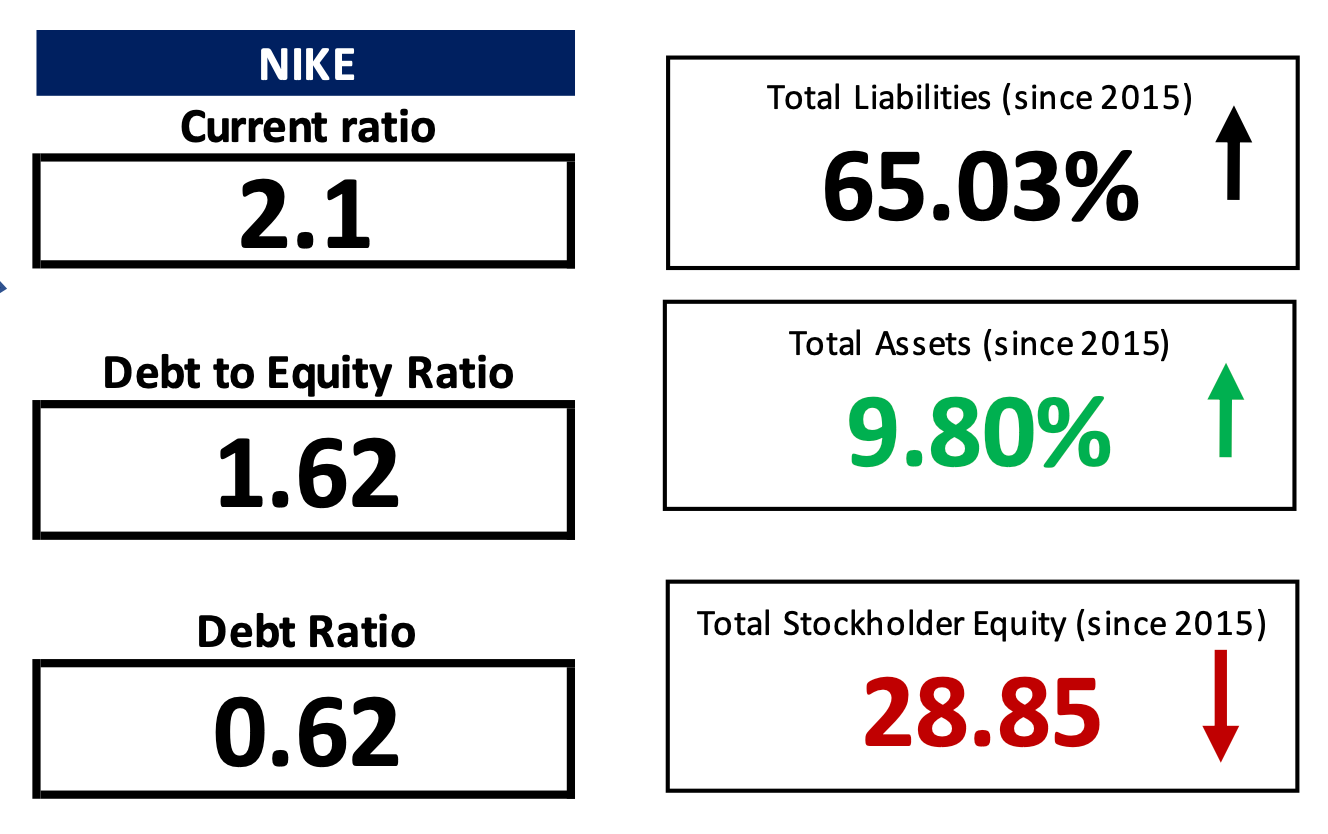

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium

:max_bytes(150000):strip_icc()/AdidasvNikeVUAAChartthrough12-13-21-4355f9a652254805995585d175ea0f4f.png)